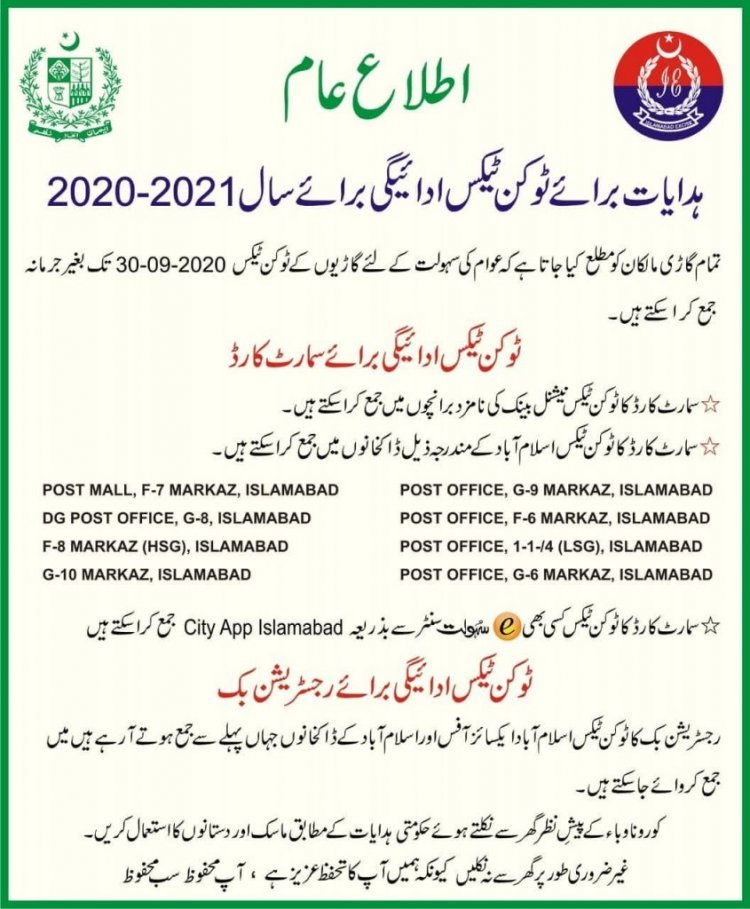

Online Vehicle Token Tax Calculator Islamabad

if looking forward that how much you need to pay the token tax for your car then our this post will help in token tax calculator for islamabad vehicles.

ICT is responsible for registering and transferring vehicles. The Government of Pakistan collects taxes and excise duties. The department collects various taxes, including Entertainment Duty, Professional Tax, and Education Cess.

Mobile registration is also available through ICT Administration.

In addition, the teams closely monitor non-custom-paid vehicles. City Islamabad App is the official mobile app for accessing the service.

How To Check Token Tax in islamabad

To enforce this campaign, the Islamabad Traffic Police assisted excise team members. They also issued challans to violators for tinted glasses.

Mobile smartphone apps offer various services, including token tax payments.

- Go to the official website.

- As soon as you open the site, the window will appear. You can view vehicle details by clicking on it.

- The window for requesting a registration number will appear.

- Click the search button after entering the registration number.

- The vehicle details will display in a table, including registration number, chassis number, engine number, registration date, vehicle price, year of manufacture, colour, and token tax paid.

- Ownership data will be visible also in a separate tab.

Token Tax Calculator Islamabad Vehicles

Different regions in Pakistan has introduce their own system to calculate the token tax and also the ratio of vehicle tax varies region to region. Folloiwng are the charts available where you can find all the taxes, duties, regitatrion amount and token tax amounts for your cars.

Car Registration Fee in Islamabad

| Vehicle category | Engine power | Car cost |

| Private / Public | 999 cc and below | 1% |

| Private / Public | From 1000 to 1999 cubic meters. | 2% |

| Private / Public | 2000 cc and above | 4% |

| Commercial | 999 cc and below | 1% |

| Commercial | 1000 cc and above | 2% |

Advance Tax in Islamabad on New Cars

| Engine power | Filer (in rupees) | Non- Filler (in rupees) |

| Up to 850 cubic meters. | 10 000 | 20 000 |

| From 851 to 1000 cubic meters. | 20 000 | 40 000 |

| From 1001 to 1300 cubic meters. | 30 000 | 60 000 |

| From 1301 to 1600 cubic meters. | 50 000 | 100 000 |

| From 1601 to 1800 cubic meters. | 75 000 | 150 000 |

| From 1801 to 2000 cubic meters. | 100 000 | 200 000 |

| From 2001 to 2500 cubic meters. | 150 000 | 300 000 |

| From 2501 to 3000 cubic meters. | 200 000 | 400 000 |

| Over 3001 cubic meters | 250 000 | 500 000 |

Token Tax on Vehicles in Islamabad

| Car categories | Engine capacity / number of seats | Amount (in rupees) |

| MOTORCYCLE AND SCOOTER (two- and three-wheeled vehicles) | ||

| Motorcycle / Scooter | Up to 200 cubic meters. | 1000 (lifetime) |

| —— | From 201 to 400 cubic meters. | 2000 (lifetime) |

| —— | 401 cc and above | 5,000 (for life) |

| FOUR WHEEL CARS | ||

| Private / Public | Up to 1000 cubic meters. | 10,000 (lifetime) |

| —— | From 1001 to 1300 cubic meters. | 1,500 |

| —— | From 1301 to 1500 cubic meters. | 4 000 |

| —— | From 1501 to 2000 cubic meters. | 5 000 |

| —— | From 2001 to 2500 cubic meters. | 8 000 |

| —— | From 2501 onwards | 12 000 |

| COMMERCIAL VEHICLE | ||

| MOTOR CABIN up to 6 seats | Up to 1000 cubic meters. | 600 |

| —— | From 1001 cm and above | 1,000 |

| Public vehicles | 8 to 12 seats | 200 per place |

| —— | 13 to 14 seats | 250 per place |

| —— | 15 to 16 seats | 300 per place |

| —— | From 17 to 41 seats | 300 per place |

| —— | From 42 to 51 seats | 400 per place |

| —— | 52 and above | 500 per seat |

| Loading vehicles / trucks | Full weight no more than 1250 kg. | 500 |

| —— | Gross weight more than 1250 kg, but not more than 2030 kg | 800 |

| —— | Gross weight more than 2030 kg, but not more than 4060 kg | 2 000 |

| —— | Gross weight more than 4060 kg, but not more than 6090 kg | 3 000 |

| —— | Gross weight over 6090 kg, but not more than 8120 kg | 3500 |

| —— | Gross weight over 8120 kg | 4 000 |