Understanding EOBI and Maximizing Your Pension Claims

Discover the intricacies of the Employees' Old-Age Benefits Institution (EOBI) and learn how to efficiently claim your pension. Maximize your pension benefits with this comprehensive guide.

Our organization firmly believes in empowering individuals with the knowledge and tools they need to make informed decisions about their financial future. In today's fast-paced world, it's crucial to understand the intricacies of programs such as the Employees' Old-Age Benefits Institution (EOBI) and how you can efficiently claim your pension. In this comprehensive guide, we will delve into the details of EOBI, shed light on the pension claiming process, and equip you with the necessary information to maximize your pension benefits.

Unveiling the Essence of EOBI

The Employees' Old-Age Benefits Institution (EOBI) is a social security organization established by the Government of Pakistan. Its primary objective is to provide financial protection and social assistance to retired employees, ensuring a secure future for individuals who have dedicated their lives to the workforce. EOBI operates under the provisions of the Employees' Old-Age Benefits Act 1976, which mandates that employers and employees contribute to the EOBI fund.

The Importance of EOBI for Your Retirement

Participating in the EOBI program is vital for securing your retirement and ensuring a stable income during your golden years. You are investing in your future financial well-being by actively contributing to the EOBI fund throughout your career. The EOBI program offers a range of benefits, including:

- Pension Payments: EOBI provides a monthly pension to eligible individuals after they reach the age of 60. This regular income stream can significantly contribute to your financial stability during retirement.

- Survivors' Pension: In the unfortunate event of your demise, the EOBI program extends support to your dependents by offering a survivors' pension. This ensures that your loved ones are protected and financially secure even after you're gone.

- Invalidity Pension: If you experience a permanent disability that renders you unable to work, EOBI offers an invalidity pension to assist you during this challenging period.

- Old-Age Grants: EOBI also provides one-time grants to eligible individuals who have contributed to the fund but do not qualify for regular pension payments for various reasons.

Claiming Your EOBI Pension: A Step-by-Step Guide

Now that you understand the importance of EOBI, let's walk through the process of claiming your pension. By following these steps diligently, you can ensure a smooth and hassle-free experience:

Step 1: Eligibility Verification

The first step in claiming your EOBI pension is ensuring you meet the eligibility criteria. Generally, individuals who have reached the age of 60 and have contributed to the EOBI fund for a minimum of ten years are eligible for pension payments. However, specific eligibility requirements may vary, so it's crucial to consult the official EOBI guidelines or contact their representatives for precise information.

Step 2: Gathering Required Documentation

To initiate your pension claim, you must gather certain essential documents. These typically include:

- National Identity Card (NIC): A valid NIC is essential for identifying and establishing your EOBI benefits eligibility.

- Employment Records: Collect relevant employment records, such as appointment letters, salary slips, or any other documentation that verifies your employment history and EOBI contributions.

- Bank Account Details: Ensure you have an active bank account where your pension payments can be conveniently deposited.

Step 3: Completing the Pension Application

With the necessary documentation, it's time to fill out the EOBI pension application form. This form serves as an official request for your pension benefits. It is vital to provide accurate and up-to-date information to avoid any delays or complications in processing your claim.

Step 4: Submission and Follow-Up

Once the application form is complete, submit it with all the required documents to the designated EOBI office or through the online portal, if available. Remember to keep copies of all the submitted documents for your records.

Step 5: Verification and Processing

After receiving your application, the EOBI officials will thoroughly review and verify the provided information and supporting documents. This verification process may take some time, so patience is important. During this stage, the EOBI may contact you for any additional information or clarification.

Step 6: Pension Approval and Disbursement

Once your application has been verified and processed, the EOBI will notify you of the pension approval. You will receive a formal confirmation letter or notification specifying the amount of your monthly pension and the date from which the payments will commence. The EOBI typically disburses pension payments through direct deposit into your nominated bank account.

Step 7: Periodic Pension Review

It's crucial to note that the EOBI periodically reviews pension cases to ensure continued eligibility and accurate benefit calculations. Therefore, promptly informing the EOBI of any changes in your circumstances, such as an address, marital status, or employment status, is essential. This will help maintain your pension payments' smooth flow and prevent unnecessary interruptions.

Tips to Maximize Your EOBI Pension Claims

While the EOBI program provides valuable financial support during retirement, there are a few additional steps you can take to maximize your pension claims and ensure a comfortable retirement:

- Stay Updated: Keep informed about changes or updates in EOBI policies, procedures, or eligibility criteria. Regularly visit the official EOBI website, read official notifications, or consider subscribing to their newsletters for the latest information.

- Maintain Employment Records: Throughout your career, maintain proper employment records, including appointment letters, salary slips, and EOBI contribution statements. These documents will prove your contributions and help streamline the pension-claiming process.

- Utilize Professional Guidance: If you find the EOBI pension claiming process complex or overwhelming, don't hesitate to seek professional assistance. Financial advisors, retirement planners, or legal experts with expertise in social security programs can provide valuable guidance and ensure you make the most of your EOBI benefits.

- Plan for Retirement: Besides EOBI, consider other retirement savings and investment options to supplement your pension income. Consult financial advisors to create a comprehensive retirement plan tailored to your needs and goals.

By following these tips and diligently navigating the EOBI pension claiming process, you can optimize your pension benefits and pave the way for a financially secure retirement.

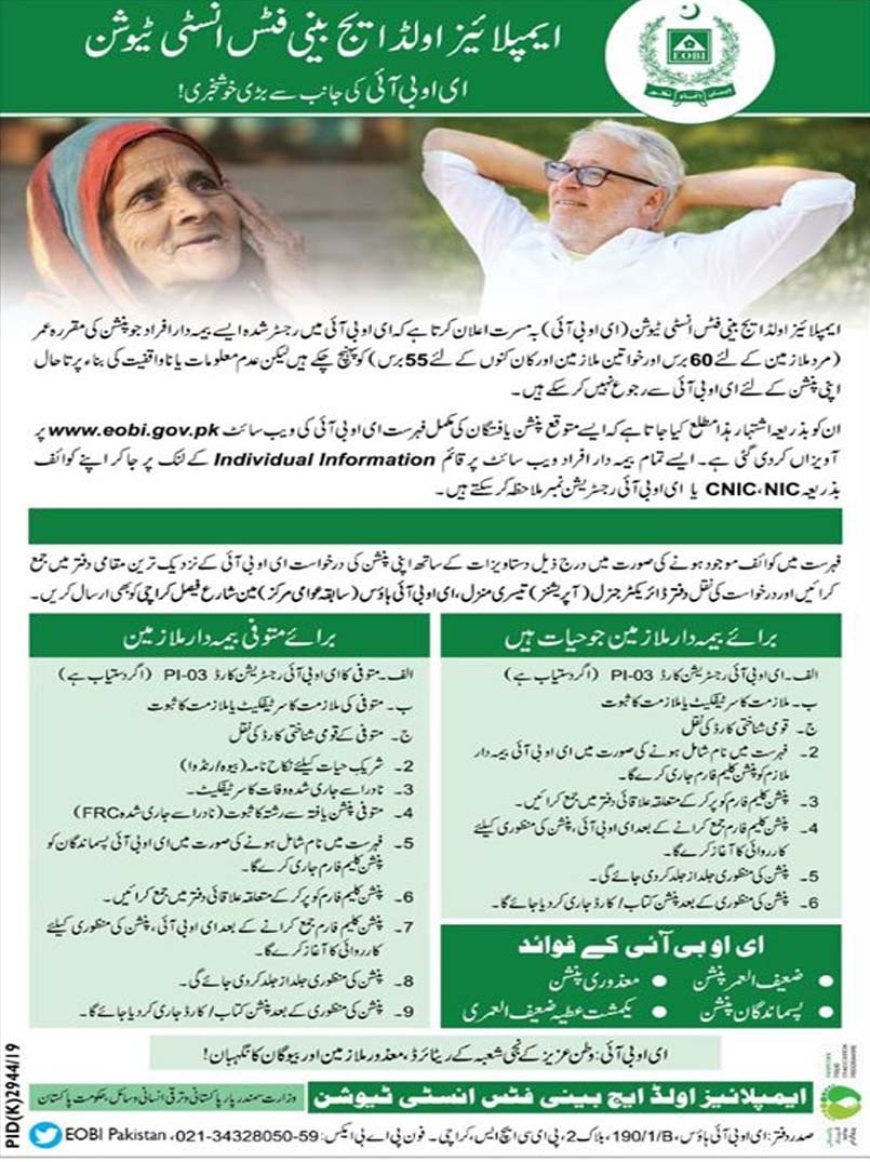

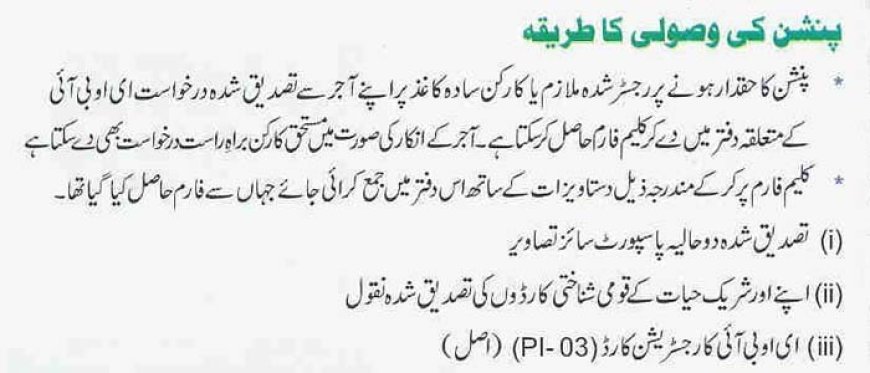

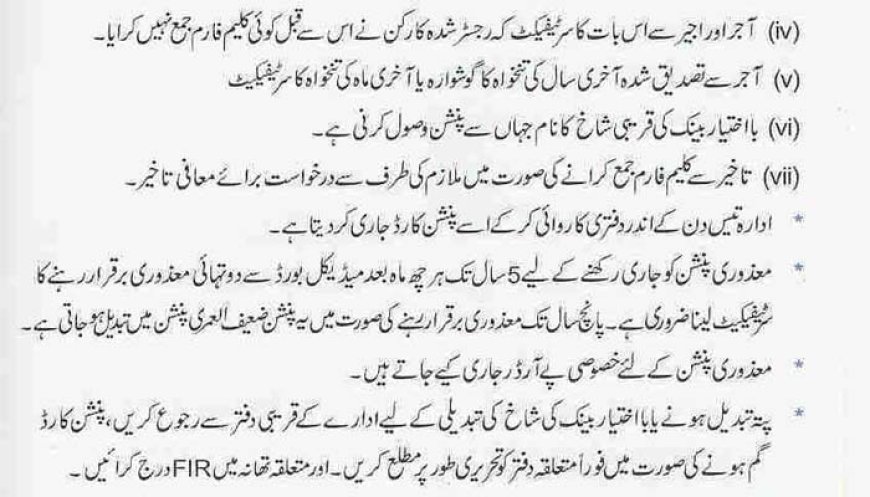

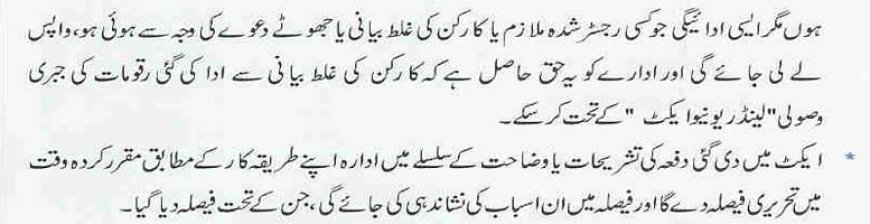

How to Receive Pension Complete Details in Urdu

Please follow the following instructions in order to receive your EOBI pension. These are the officials EOBI instructions writen in urdu so people can understand easily.

Conclusion

Securing your financial future is of utmost importance, and the Employees' Old-Age Benefits Institution (EOBI) plays a pivotal role in providing retirement benefits and support. Through this comprehensive guide, we have shed light on the essence of EOBI, elucidated the pension claiming process, and offered valuable tips to maximize your pension claims.

Remember, by actively participating in the EOBI program, maintaining accurate records, and staying informed about policy changes. You can optimize your pension benefits and enjoy a comfortable retirement. Plan, gather the necessary documentation, and embark on the journey to confidently claim your EOBI pension.

Disclaimer: The information provided in this article is for general informational purposes only and should not be considered as financial or legal advice. For precise and up-to-date information regarding the EOBI program and pension claiming process, please consult the official EOBI website or seek professional guidance from qualified experts.